Ready to start winning with money?

Personalized Financial Coaching

Ready to take control of your finances but don’t know where to start? Our personalized financial coaching sessions are designed to help you build a clear, actionable plan to manage your money with confidence.

With no ongoing commitment and a flexible pay-as-you-go approach, we’re here to guide you through budgeting, debt payoff strategies, and more—all in a 90-minute coaching session. You’ll leave with a tailored plan, exclusive tools to stay on track, and the confidence to reach your financial goals.

Let’s turn financial stress into financial clarity, together.

How it works

1

schedule your session

Book a coaching session time that works for you. You’ll get a confirmation email with all the prep details.

2

Share your information

Fill out a questionnaire about your finances and goals. This helps us personalize the coaching session to you.

3

meet your coaches

Meet with Lauren and Nick for your 90-minute call. We’ll craft a budget, debt payoff strategy, and show you how to use our tools.

4

take control of your finances

Leave with a clear plan, helpful tools, and the confidence to manage your money. Book more sessions as needed.

Everything included

90min Financial Coaching session

During our call, you’ll work directly with Lauren and Nick, experienced financial coaches who bring a combined approach to help you create a personalized financial plan.

Custom-tailored budget

Together, we’ll design a budget tailored to your goals, giving you a clear path to feel confident and in control of your money.

Personalized debt payoff plan

We’ll develop a personalized plan to tackle your debt, factoring in your income and financial goals for a clear and achievable strategy.

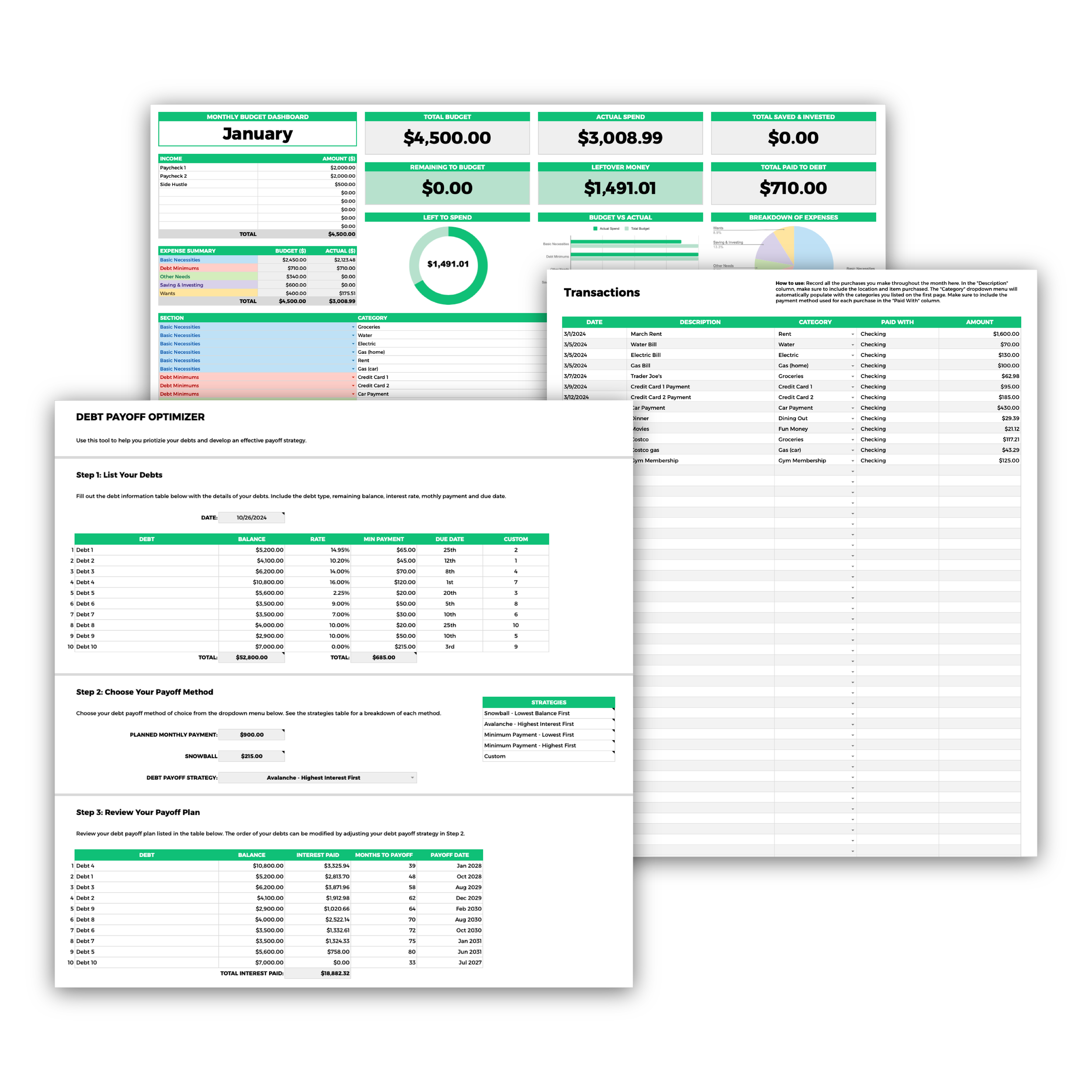

exclusive financial tools

Instant access to our Budget Dashboard & Expense Tracker, for easy money management and our Debt Payoff Optimizer to help you efficiently pay off your debt.

FAQs

-

Not at all. In fact, most people we work with start financial coaching with some form of debt. Together we’ll create a plan to eliminate your debt and build wealth through better financial habits.

-

A true desire to improve your current financial situation. Beyond that, we’ll guide you through every step of the process. It will be important to think about your goals prior to our coaching session.

-

Yes! In fact, married couples are encouraged to participate in financial coaching sessions together. Non-married couples are encouraged to work on their personal finances in separate sessions.

-

No. As financial coaches, we focus on your education, growth, and decision making surrounding your personal finances. While we can help you understand what investing is, we do not provide specific investing advice.